Welcome to our comprehensive guide on dabba trading. Here, we’ll delve into the intricacies of this unofficial trading system, exploring its benefits, drawbacks, and how it differs from regular stock trading. Whether you’re curious about its potential or concerned about its risks, this guide covers everything you need to know.

Dabba Trading Definition?

Dabba trading,” a term found primarily in Indian financial circles, refers to the illegal practice of dealing in securities outside regulated banks. Essentially, it operates as an underground market, attracting government oversight mechanisms by regulators such as regulatory authorities Securities and Exchange Board of India (SEBI).

This covert operation is carried out primarily through intermediaries known as “can handlers.” Thesperators pose as legitimate traders but operate without following legal guidelines. Here’s a closer look at Dabba’s commercial in action:

- Off-Market Transactions: Unlike traditional trading facilitated through recognized stock exchanges like National Stock Exchange (NSE) or Bombay Stock Exchange (BSE), dabba trading transactions are conducted off-market which means to take trading reports not show legislatures, This for a market parallel shadow.

- Lack of Regulation: Lack of regulatory oversight is a major determinant of the sale of the bottle. The transactions are outside the jurisdiction of SEBI, exposing investors to various malpractices, insider trading and fraudulent practices

- Excessive Profit Promises: Do traders often lure unsuspecting investors with promises of unusually high profits in a short period of time. Such statements capitalize on investors’ desire for quick returns but conceal the inherent risks of the bottle industry including the lack of investor protection mechanisms.

- Legal Implications: Tobacco indulgence is a punishable offense under Indian law, and carries severe legal consequences for traders and operators In order to hit their creditors safeguarding the interests of the insiders, the authorities constantly monitor and control such activities to maintain the integrity of the financial market.

To check the challenges and risks associated with dabba trading, investors are advised to opt for appropriate options, such as opening Demat accounts with authorized trading companies Here is why:

- Compliance: Demat transactions operate within established regulatory guidelines, ensuring transparency, accountability and protecting investors. Transactions through Demat accounts are legally reported to regulatory authorities, reducing the risk of illegal activities.

- Security and Transparency: Demat accounts provide a secure electronic platform to hold security and transactions in a transparent manner. Investors can track their investments in real-time, with easy access to detailed transaction history and quotes.

- Simple and efficient: Opening a demat account simplifies the financial process, eliminating the hassles associated with physical share certificates and paperwork. Deals are made quickly, and simple resolution mechanisms increase overall efficiency.

- Access to market opportunities: Demat Accounts have access to a wide range of investments across a range of assets including equities, mutual funds, bonds, derivatives etc. This diversification enables investors to diversify portfolios consistent with their financial objectives and risk tolerance.

In conclusion, while the bottle industry can promise lucrative returns, it comes with risks and major legal ramifications. By opting for the right options like Demat Accounts, investors can safely access financial markets, with compliance, safety and transparency as their guiding principles.

What is Dabba Trading?

Can Dabba Trading also known as bucket trading or parallel trading is an illegal practice that is prevalent in some parts of the world, especially India. This involves non-market trading, where brokers trade on behalf of clients without actually banking them. Instead, they keep a separate record of transactions, called ‘Dabba’, which is essentially a parallel market.

Here’s How Dabba Trading Usually Works:

- Off-Exchange Trading: Unlike legal trading on stock exchanges like National Stock Exchange (NSE) or Bombay Stock Exchange (BSE), dabba trading is off-market which means that trading is not reported to regulatory authorities and does not contribute to government market funds .

- Irregular transactions: Since dabba trading operates outside the jurisdiction of regulatory agencies like Securities and Exchange Board of India (Sebi), there is little oversight. This lack of regulation opens the door for various malpractices like market dynamics and insider trading.

- The promise of high returns: Do traders tend to attract investors by promising and promising quick returns. It can be argued that they offer lower trading costs or higher leverage compared to normal exchanges. However, these promises are often misleading, and investors risk losing large sums of money due to a lack of transparency and accountability.

- Legal ramifications: Engaging in bottle trading is illegal and can have serious consequences for traders and merchants. To protect investors and maintain the integrity of financial markets, regulators actively monitor and control such activities.

It is important for investors to stay away from bottle trading and choose appropriate strategies for buying and selling securities. Opening a demat account with a reputable custody company authorized by regulatory bodies ensures transparency, security and compliance with applicable laws and regulations

A demat account, short for dematerialized account, is an electronic warehouse where securities are transferred digitally. By opening a demat account, investors can enjoy several benefits:

- Convenience: Holding non-physical securities eliminates the need for physical certification, making it easier to manage and manage investments.

- Security: Demat accounts provide a secure means of holding security, reducing the risk of loss, theft, or destruction associated with physical credentials.

- Efficiency: Transactions through demat accounts are handled electronically, resulting in faster payment times and less paperwork.

- Access: Investors can access their demat accounts online, allowing them to manage their portfolios, view transaction history and execute trades conveniently from anywhere with an internet connection

In conclusion, while trading may seem enticing due to the promise of high profits, it is important to be aware of the associated risks and legal implications. Opening a Demat Account with a reputed brokerage ensures compliance with regulatory requirements and provides a safe and transparent platform for investment.

The History of Dabba Trading?

The business history of Dabba dates back to the early days when the banking market was booming in India. The can trade, the origin of informal business practices, continues despite regulatory efforts to curb its spread. Here is an overview of that historical context:

- Early origins: Dabba trading originated from informal trading systems that predated the establishment of formal stock exchanges in India. In the absence of organized trade forums, individuals interacted with peers, laying the foundation for what later became the barrel trade

- Emergence of stock exchanges: With the establishment of formalized stock exchanges like the Bombay Stock Exchange (BSE) in the 19th century, the Indian financial market landscape changed dramatically but smuggling practices began to emerge affecting trade and the progress of appropriate policies.

- Growth and Expansion: Over the years, the bottle industry has grown as a result of technological advancements and changes in market dynamics. Initially confined to local networks, it has gradually expanded its reach by leveraging telecommunications networks and digital platforms to facilitate non-market communications

- Legal intervention: Despite its clandestine nature, dabba trading attracted legal attention as authorities sought to protect the integrity of financial markets and investor interests Regulatory agencies hear that the Securities Exchange Board of India (Sebi) initiated measures to curb the spread of dabba trading, including stringent enforcement actions and awareness campaigns.

- Ongoing challenges: Despite regulatory efforts, can trading persists in certain pockets of the Indian economy. It is sustained by factors such as loose enforcement, technological advances that enable anonymity and the attraction of quick profits.

In conclusion, the history of dabba trading reflects the complex historical, technological and regulatory factors shaping the evolution of Indian financial markets. Efforts are underway to curb dabba trading, and continue to emphasize the need to continue vigilance and educate the investors. Opting for appropriate channels such as Demat Accounts ensures compliance with regulatory norms and provides investors with safe and transparent access to the stock market.

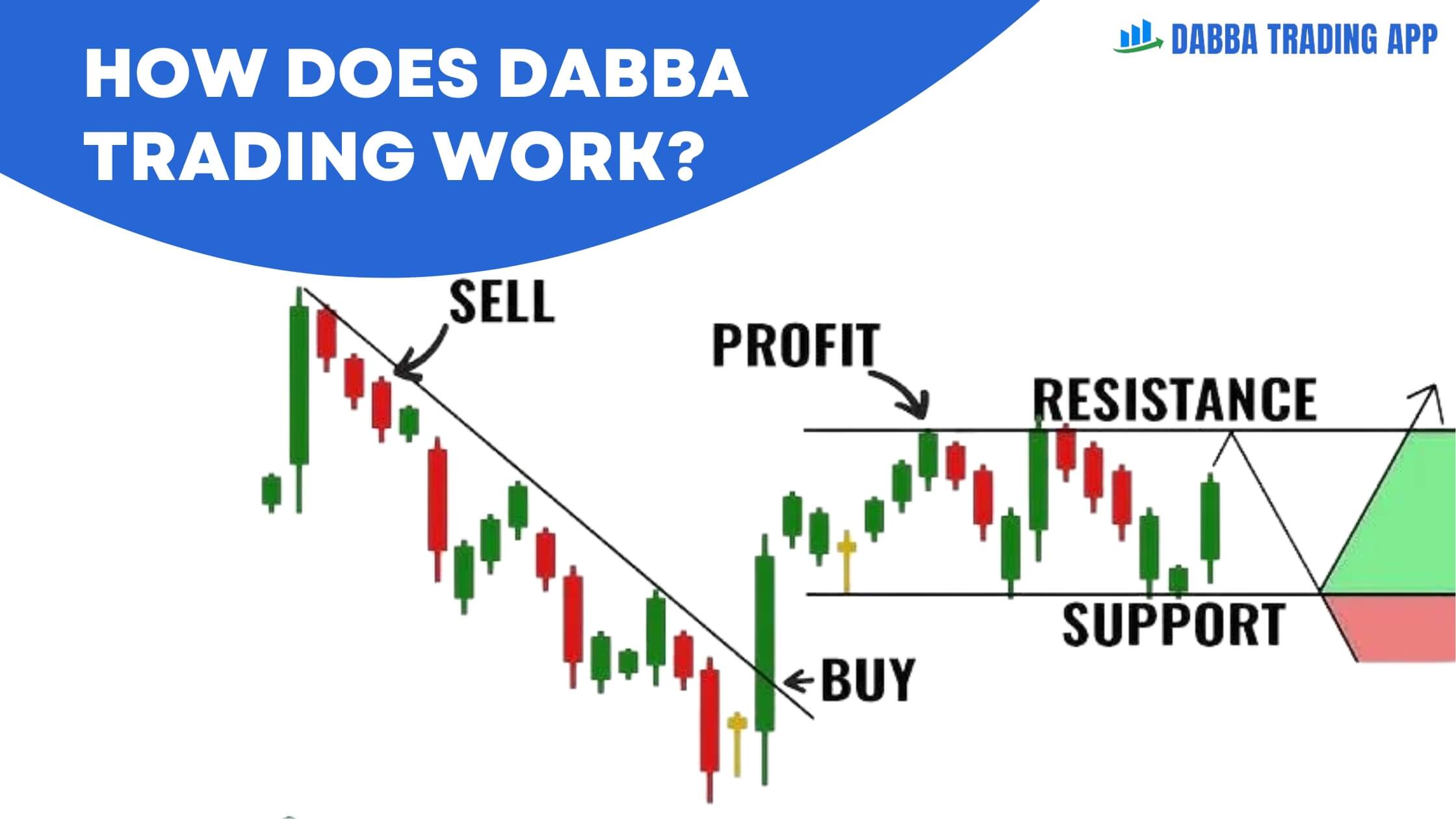

How does Dabba Trading Work?

The illegal practice of stock Market Trading Work is deeply rooted in India’s economic history. To understand its origins, we need to examine how financial markets developed in India and the socio-economic factors that gave rise to this latent activity. Here are five key factors that explain the origins of the can industry:

- Leading financial markets: Prior to the formation of equity markets, shares in India were traded in informal markets. Merchants and traders transacted on the basis of oral trust and agreement, and were not governed by any legal framework. These informal practices laid the foundation for what later became the bottle trade. The absence of a structured legal mechanism meant that merchants operated in a relatively independent and flexible manner, a tradition that continued with the introduction of formal barter.

- Formal exchange: The Bombay Stock Exchange (BSE), founded in 1875, pioneered organized trading in India. This brought transparency, rules and order to the financial markets. However, not all market participants were comfortable with these changes. Many traders, accustomed to informal methods, found the new regulatory requirements burdensome. To avoid scrutiny and restrict formal exchanges, some traded on that platform, giving rise to bottle trading. They preferred the old ways of doing business, which offered greater flexibility and confidentiality.

- Resistance to Regulation: With the publicization of stock exchanges, there has been an increase in regulatory oversight. Businesses had to follow strict rules and reports. Some manufacturers, especially those who have been successful in the informal market, have resisted these changes. They found ways to use offshore official exchanges to avoid regulatory scrutiny. This opposition to regulation was a major factor in sustaining the dabba trade. The appeal of traders without following strict rules attracted many people to the dabba trade.

- Advanced Technology: The advent of telecommunications and digital technologies has facilitated the growth of the dabba business. Traders could now efficiently execute off-market trades using telephones and, later, the Internet. This technology allowed dabba operators to maintain separate records (‘dabba’) and trade without reporting them to official exchanges. The ease and speed of these transactions made the dabba trade even more popular. Technology has enabled the dabba industry to reach a wider audience and conduct more business without interference from regulators.

- Economic incentives: Economic factors, such as high taxes and transaction costs associated with the business process, have also contributed to the persistence of the dabba trade. Investors seeking higher profits and lower costs have been drawn to the low trading fees and high leverage offered by dabba operators, despite the risks involved. The ability to earn more in a short period of time made the dabba business attractive. In addition, the illegal dabba business has allowed investors to avoid taxes and other fees associated with the business, encouraging them to continue doing so to participate in this violent act.

Opening a Demat Account with a reputed brokerage firm is a step in the right direction. Demat accounts provide a secure and legitimate trading platform, provide compliance, investor protection and ease of transactions. By choosing the right trading strategies, investors can contribute to a stable and credible financial market, leading to sustainable economic growth and stability.

Difference between Legal Trading and Dabba Trading?

Understanding the fundamental difference between legal trading and Dabba trading is critical for investors to make informed decisions and protect their investments. Here’s a detailed comparison:

1. Legal Review:

- Legal Trading: Legal trading is done through recognized stock exchanges like National Stock Exchange (NSE) or Bombay Stock Exchange (BSE). These exchanges operate under the supervision of regulatory bodies such as the Securities and Exchange Board of India (Sebi). The business is transparent, regulated and legal guidelines must be strictly followed.

- Can trading: On the other hand, can trading operates outside of regulated banks and regulatory oversight. Trading is done in the marketplace without regulatory scrutiny. This lack of regulation exposes investors to risks such as fraud and market volatility.

2. Process Logic and Statistics:

- Legal Trading: Legitimate trading systems ensure transparency and accountability through strong reporting mechanisms. Trading is conducted electronically, allowing investors to monitor transactions and details in real time. Market activities are based on statutory audits and analysis to ensure accuracy and accuracy.

- Can business: Can business lacks transparency and accountability. Negotiations are carried out through parallel processes monitored by bottle producers, with little or no visibility of the actual business processes. Investors may not receive accurate reports of their trading, increasing the risk of contradictions and fraudulent practices.

3. Bank security:

- Legitimate trading: Legitimate trading strategies prioritize investor protection by implementing safeguards such as investor education programs, dispute resolution mechanisms, investor reimbursements, and so on.

- Can Trading: Can trading provides minimum protection for investors. Investors who trade after the market cannot participate in case of transaction or fraud. The lack of regulatory oversight increases the risk of financial loss and legal repercussions for investors.

4. Market Integrity:

- Legal trading: Legitimate trading contributes to market integrity by providing transparency, liquidity and price dscovery. Market participants operate within a regulated framework and comply with rules and regulations aimed at ensuring market stability and confidence.

- Can trading: Can trading undermines the integrity of the market by operating in the shadows, outside of regulated exchanges. Interactions in the market can distort market prices and impair the performance of the price discovery method. Moreover, the proliferation of bottle sales poses a reputational risk to the wider financial system.

Risks to Dabba or Box Trading?

Disclosure of the risks associated with bottle or box trading is important for investors to make informed decisions and protect their financial interests. Here is a detailed summary:

- Legal Consequences: Engaging in bottle or box marketing is illegal and punishable under Indian law. Investors and employees who engage in off-market trading run the risk of legal consequences, including fines and imprisonment. Employment of informal supervisory restrictions places individuals at risk of enforcement.

- Lack of banking security: Compared to normal trading strategies, can or box trading offers investors little protection. Investors engaged in off-market trading cannot engage in litigation or fraudulent activity a. Lack of regulatory oversight increases the risk of loss and erodes investor confidence.

- Fraudulent Practices: The can or box business is vulnerable to a variety of deceptive practices, including market manipulation, insider trading, and unauthorized trading activities Can operators may engage in deceptive practices to deceive investors with promised forms of maximizing returns through off-market trading to hide associated risks.

- Market Values: The lack of transparency and regulatory oversight in the bottle or box industry provides fertile ground for commercial reform. Can operators manipulate or increase the value of their investments to exploit investors for their own profit. Such abusive practices distort market dynamics and undermine the integrity of financial markets.

- Business Risks: The can or box business poses business risks due to its informal and unregulated nature. Investors may encounter difficulties executing trades, obtaining accurate information, or resolving disputes with bottle operators. The lack of standardized processes and procedures increases the potential for errors and inefficiencies.

- Capital loss: By participating in bottle or box trading, investors risk losing capital. The lack of regulatory oversight and transparency increases the risk of investment fraud, Ponzi schemes and fraudulent activities. Investors can lose their capital investments in non-market transactions without exposure or compensation.

- Defamation: Participation in bottle or box sales can financially damage an investor’s reputation and credibility. Working outside legal and ethical standards undermines trust and integrity, and can damage long-term business relationships and financial opportunities.

In conclusion, can or box trading presents significant risks to investors, including regulatory implications, lack of investor protection, fraudulent practices, market volatility, operational risk, capital loss and reputational a they destroy Investors are encouraged to opt for appropriate options such as opening Demat Accounts with authorized brokerage firms regularly and transparently provide the platform, ensuring investors can participate in the stock market safely and responsibly . . . .

The Impact of Dabba Trading on the Indian Taxation System?

Can trading, an illegal activity that operates outside of regulated financial markets has a significant impact on different parts of the economy, including the Indian tax system, and to understand what illegal activity is this method means great understanding of these effects is important.

- Loss of tax revenue: Can trade takes place in the marketplace and is not reported to law enforcement or tax departments. As a result, income from such businesses is unaccounted for, resulting in significant tax evasion. The government loses out on capital gains tax, securities transaction tax (STT), and other taxes associated with legitimate business activities.

- Damage to tax compliance: The prevalence of sales tax encourages tax evasion and undermines the culture of tax non-compliance. When investors and traders engage in off-market transactions to avoid taxes, it creates an uneven playing field and frustrates honest taxpayers. This erosion of trust in the tax system can lead to a significant reduction in voluntary tax compliance.

- Economic distortions: Accurate financial information is critical to effective tax planning and budgeting. Can trading distorts this data by forming a parallel market without officially listing the industry. This lack of transparency hinders the government’s ability to truly measure the scope of economic activities and accurately assess the tax base.

- Challenges to tax enforcement: The secretive nature of the bottle trade poses major challenges for tax authorities. Identifying and tracking off-market trading requires a wealth of resources and sophisticated detection techniques. The informal transactions and anonymity associated with trade further complicate enforcement efforts, making it difficult for tax authorities to effectively detect and prevent tax evasion.

- Impact on government spending: The loss of revenue due to tax trading and associated tax evasion limits the government’s ability to pay for public services and infrastructure. Declining tax collections affect the budget for essential services such as health, education and social welfare. Consequently, it adversely affects the country’s overall economic growth and social welfare.

In conclusion, trade can significantly affect the Indian tax system through loss of tax revenue, compromise of tax compliance, distortion of financial information, challenge of tax administration and impact on government finances To minimize these effects and ensure fair and transparent financial market investors, legal trading activities through regulated channels are encouraged to be conducted.

Opening a Demat Account with a reputed brokerage firm is a good step towards supporting the fixed income and complying with tax laws. The Demat Account provides a secure and transparent method of banking transactions, ensuring that all transactions are recorded and reported to the relevant authorities. This not only contributes to sound and equitable budgeting but also contributes to national development through adequate tax collection. By choosing the right business models, investors can participate in economic development in a responsible and sustainable way.

How does Dabba Trading work in India?

Dabba trading, an illegal and shadowy activity, is bypassing the regulated framework of banks in India. Understanding how dabba trading works can shed light on the risks involved and highlight the benefits of opting for legal, regulated trading channels such as Demat Accounts. Here’s a detailed look at how the can business works.

- Communication in the marketplace: Dabba trading takes place outside government stock exchanges such as the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Instead of trading on these regulated platforms, transactions are conducted outside the market through informal channels. This means that trading is not registered in the official trading system and kept out of scrutiny by regulatory bodies such as the Securities and Exchange Board of India (Sebi).

- Role of Dabba makers: The main players in the canning industry are canners, who act as intermediaries between buyers and sellers. These entrepreneurs established informal trading agencies facilitating the buying and selling of securities. Investors place their orders with the bottler, who executes these implicit orders. The performer keeps a special book, called a ‘dabba’, to record these transactions. This book is not shared with any law enforcement agency, preventing government officials from inspecting businesses.

- Application of Work: When an investor makes a bottle offer to a bottler, the investor replicates an actual transaction but does not do so at the official auction. Instead, the employees match trade between it and its network. Trade prices are usually based on current market prices, but are still unlisted. This will allow investors and employees to avoid taxes, transaction fees and other related legal costs

- The promise of great profits: Dabba trading often attracts investors with the promise of high returns. Entrepreneurs can offer lower marketing costs, higher cash flow, and faster profit potential. However, these benefits come with significant risks. The absence of regulatory oversight means no protection from fraud, market manipulation or other unethical practices. Investors are completely at the mercy of an operator’s honesty and integrity.

- Legal and Financial Risks: Engaging in bottle trading is illegal and carries serious legal consequences. Operators and investors risk legal action, including fines and imprisonment. In addition, because these industries are not regulated, the economic losses are high. If investors have no recourse if the bottle user is incapacitated, disappears, or engages in fraudulent activity. The lack of transparency and accountability means that investors are exposed to severe risk with no protection.

Why should you choose to Trade Legally with a Demat Account?

Understanding the technology of bottle marketing, emphasizes the importance of choosing the right marketing strategies. Opening a Demat Account with a reputed brokerage firm gives you several benefits:

- Regulatory Compliance: Demat accounts operate on a policy governed by SEBI, ensuring that all transactions are transparent and compliant.

- Investor protection: Legitimate trading platforms offer a range of protections including investor education, dispute resolution mechanisms and compensation funds.

- Transparency and Accountability: Every transaction in a demat account is recorded and can be tracked, giving you a clear picture of your trading activities.

- Simple and convenient: Demat accounts simplify the trading process, enabling fast, secure and efficient transactions without the need for physical share certificates.

By opting for a Demat Account, investors can trade with confidence, knowing that their investments are safe and regulated. This not only protects their financial interests but also contributes to the integrity and stability of the financial markets.

Why is Dabba Trading Illegal?

Dabba trading, an illegal off-market trading practice, operates outside the regulated financial framework, posing significant risks and challenges to the integrity of the financial markets. Understanding why dabba trading is illegal is crucial for appreciating the importance of regulated trading avenues. Here are the key reasons:

- Lack of Regulatory Oversight: Dabba trading bypasses the regulated stock exchanges like the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). This means that transactions are not subject to the scrutiny and regulations imposed by the Securities and Exchange Board of India (SEBI). Without regulatory oversight, there is no mechanism to ensure fair trading practices, transparency, and accountability.

- Tax Evasion: One of the primary reasons dabba trading is illegal is because it facilitates tax evasion. Trades conducted through dabba operators are not recorded on official exchanges, allowing investors to avoid paying capital gains tax, securities transaction tax (STT), and other levies. This deprives the government of significant revenue, which could otherwise be used for public services and infrastructure development.

- Investor Protection: Regulated trading platforms provide various safeguards to protect investors, including investor education initiatives, dispute resolution mechanisms, and compensation funds. In contrast, dabba trading offers no such protections. Investors engaging in off-market trades are exposed to a high risk of fraud, manipulation, and financial loss without any legal recourse or protection mechanisms.

- Market Integrity: Can trading undermine the integrity of financial markets. Operating outside the regulated framework creates a parallel market that is vulnerable to manipulative practices such as price manipulation, insider trading, and etc. These activities distort market prices and undermine investor confidence in the legality and fairness of the financial markets.

- Legal Consequences: It is a violation of Indian law to engage in bottle trading. Both employees and investors involved in these off-market transactions may face severe legal consequences including fines and imprisonment. Not only does the illegal trade expose individuals to legal risk not only but also contributes to the broader issue of financial market manipulation and corruption.

The Role of Technology in Dabba Trading?

Technology has played a key role in the growth and sustainability of the bottle trade, an illegal off-market trade. While technology provides many advantages for the legal trade, bottle manufacturers have also used it to facilitate their illegal activities. Understanding the role of technology in can trading highlighting the importance of choosing regulated trading systems for secure and transparent transactions. Here are five points that explain how technology is impacting the bottle industry.

- Enhanced communication channels: The advent of telecommunication technologies such as mobile phones and the Internet has made it easier for bottle manufacturers to communicate with their customers. Merchants can quickly place orders and receive updates via phone, messaging apps and email. This real-time communication enables manufacturers to do business quickly and communicate with their customers constantly, making the process more efficient and enjoyable for stakeholders.

- Digital platforms and software: Can operators often use sophisticated software and digital platforms to manage their business. These tools enable operators to simulate real market conditions and provide realistic pricing to consumers, creating a sense of legitimacy. Advanced software can process multiple tasks simultaneously, track sales and manage accounts, enabling can operators to operate with greater flexibility and efficiency.

- Anonymity and Security: The technology provides retailers with a level of anonymity that is difficult to achieve in traditional retail settings. Encrypted communication channels and secure digital channels help employees and customers communicate without leaving a paper trail. This anonymity makes it difficult for law enforcement to identify and track bottle trade activities, thus enabling the practice.

- Remote access and flexibility: Internet connectivity and the rise of mobile technology have made can trading more accessible. Customers can perform business activities from any location, without having to travel to physical offices. This remote option adds convenience and flexibility, attracting many participants in the bottle trade. The ability to work anytime and anywhere makes it easier for bottle manufacturers to expand their customer base.

- Market Manipulation and Fraud: Technology facilitates market manipulation and fraudulent activity in the bottle trade. Operators can use digital tools to falsify prices, conduct fake trades, and manipulate market data to mislead consumers. This change could result in significant losses for investors who are misled by inaccurate information. The lack of regulatory oversight in the bottle industry further exacerbates these risks, leaving investors vulnerable to the possibility of fraud.

Legal Business Recognized is Demat Account?

Understanding the role of technology in bottle marketing emphasizes the need for secure and transparent marketing processes. Opening a Demat account with a reputed brokerage firm gives you several benefits:

- Compliance: Demat accounts are regulated by the Securities and Exchange Board of India (Sebi) to ensure compliance and transparency of all transactions.

- Investor protection: Legitimate trading platforms provide robust safeguards, including dispute resolution mechanisms and compensation fees, to protect investors from fraudulent and unethical practices.

- Transparency and accountability: Every transaction in a demat account is recorded and traceable, providing clear visibility of trading activities and creating confidence in the financial system.

- Efficiency and convenience: Demat accounts streamline the trading process, enabling fast, secure and efficient transactions without the need for physical share certificates.

- Tax compliance: Legitimacy ensures that all businesses are reported and taxed appropriately, contributing to national revenue and supporting economic growth.

By choosing to trade through a Demat account, investors can enjoy a safe, regulated and transparent trading environment. This not only protects their investment interests but also contributes to the growth and stability of financial markets. Opening a Demat account is a good step towards investing properly and supporting the wider economy.

Why do People Go for Dabba Trading?

The can trade, despite being illegal, continues to attract a significant number of investors. Understanding the reasons for that appeal is essential to promoting the benefits of legal and regulated business practices. Here are the top five reasons why people choose the Dabba business.

- Low cost of goods: One of the main attractions of barrel trading is the comparatively low transaction costs of trading. Investors in a regulated business have to pay various fees such as trading fees, securities tax (STT), and other taxes. Do employees typically waive these costs or do they offer significantly lower rates, making it an attractive option for companies looking to maximize profits by reducing costs.

- High Leverage: Can trading tends to yield more returns than regulated trading systems. Leverage allows traders to control larger positions with smaller amounts of capital, which can increase profitability. This high-risk, high-reward environment appeals to investors looking for high returns in a short period of time. However, it’s important to note that while higher leverage can increase potential gains, it also increases potential losses.

- Flexibility and convenience: The informal nature of the barrel work allows for greater flexibility and convenience. Can operators generally have fewer restrictions and regulations, allowing them to work faster and easier. Investors can execute trades without the need for extensive paperwork or stringent compliance requirements. This accessibility and convenience makes can shopping attractive for those who want a hassle-free shopping experience.

- Anonymity and Confidentiality: Can trading provides some anonymity and privacy that is not available in regulated markets. Deals are made off-limits, and investors’ personal information is not disclosed to law enforcement. This anonymity is attractive to individuals who want to keep their business activities private and avoid scrutiny by tax authorities or other law enforcement agencies.

- Potential immediate benefits: The promise of quick profits and scale is a major attraction for the bottle industry. The ability to trade quickly, coupled with lower costs and higher liquidity, creates an environment where investors believe they can achieve rapid financial returns. This potential for quick returns appeals to traders, especially those with a high risk tolerance who are willing to bet on the potential rewards.

Promoting Legal Transactions with Demat Accounts?

Understanding the reasons for the popularity of bottle trading emphasizes the need to educate investors on the benefits of legal and regulated trading systems. Opening a demat account with a reputed brokerage firm gives you several benefits:

- Compliance: Demat accounts operate under the regime of the Securities and Exchange Board of India (SEBI), which ensures that all trades are transparent and comply with regulatory norms This compliance provides confidence and stability in the financial markets.

- Investor protection: Legitimate trading platforms provide robust financial protection mechanisms including dispute resolution and compensation funds, and protect investors from fraudulent and unethical practices.

- Transparency and Accounts: Every transaction in a demat account is recorded and analyzed, providing clear visibility of trading activities. This transparency ensures that investors can accurately monitor their investments and have confidence in the integrity of the market.

- Efficiency and convenience: Demat accounts streamline the trading process, enabling faster, safer and more efficient transactions. They eliminate the need for physical share certificates, reduce the risk of loss or theft and simplify portfolio management.

- Tax compliance: Legitimacy ensures that all businesses are reported and taxed appropriately, contributing to national revenue and supporting economic growth. This compliance not only contributes to sound financial management but is also consistent with responsible financial practices.

By choosing to trade through a Demat Account, investors can enjoy a safe, regulated and transparent trading environment. This not only protects their investment interests but also contributes to the growth and stability of financial markets. Opening a Demat account is a good step towards investing properly and supporting the wider economy.

Why Do Some Traders Choose the Dabba Market Over Regular Stock Exchanges?

Can market, which is illegal non-market trading, continues to attract a segment of traders despite the risks and legal implications. If we understand why some traders prefer to market to regular stock exchanges under which, it can shed light on the interesting, the advantages of regular business and why they are not empowered. Here are the main reasons why companies can choose the can market:

- Low cost of goods: One of the main attractions of the bottle market is comparatively much lower transaction costs. Traders in regulated markets are subject to fees, including transaction fees, securities tax (STT), and other statutory taxes. Operators generally pay little or no marketing fees, making it an attractive option for marketers aiming to reduce marketing costs and maximize profits.

- Higher leverage and faster profitability: The bottle market is generally more profitable, allowing traders to control larger areas with less capital. This high level of leverage can generate significant returns in a short period of time, making it particularly attractive to traders with high risk tolerance. The promise of quick and significant profits can attract traders to the barrel market, even if significant losses have increased.

- How to get there and how to make changes: The informal nature of the can market allows for greater flexibility and accessibility. Unlike regulated exchanges, which require extensive paperwork and compliance with stringent compliance regulations, Dabba trading has few bureaucratic hurdles This facility allows traders to trade quickly and minimal paperwork is required, making it appealing to those who want a more convenient shopping experience.

- Anonymity and Confidentiality: Can trading offers anonymity and a degree of secrecy that is absent from the conventional market. Transactions in the bottle market are not recorded on official exchanges, and the personal information of traders is kept confidential. This anonymity is attractive to individuals who want to keep their business activities private and avoid scrutiny by tax authorities or other law enforcement agencies. The privacy offered by the can market can be a major draw for privacy concerns.

- Rules to avoid: Some traders are drawn to the bottle market in order to avoid regulations and restrictions imposed by government retailers. Regulated markets have strict rules designed to ensure transparency, fairness and investor protection. However, some companies may view these rules as restrictive. By working in the bottle market, they can circumvent these restrictions and engage in business practices that may not be allowed under regulated policies.

Conclusion

Can trading is an illegal and dangerous activity despite its low cost, high leverage and appealing secrecy. It operates outside of regulatory oversight, making it fraught with potential pitfalls for traders who choose this route. Understanding the intricacies of the bottle business sheds light on why it continues to attract some retailers but also highlights the big risks and legal ramifications involved.

Transportation of Goods

- Lower operating costs and higher leverage: The main attraction of the bottle industry is its low cost of doing business and the promise of high returns. These factors can quickly and exacerbate profit illusions, making it tempting for those seeking to maximize returns with less but this comes with a trade-off : huge losses can occur due to lack of legal protection . . . .

- How to get there and how to make changes: Freed from the bureaucratic processes of regulated markets, the flexibility and convenience of can trading appeals to traders looking for a hassle-free experience but a system-free approach adequate controls also imply insecurity, leaving traders vulnerable to fraud and malpractice.

- Anonymity and Confidentiality: The anonymity offered by the can trade can be attractive to those who want to keep their trading activities under the radar. However, this secrecy is a double-edged sword. While it protects traders from scrutiny, it exposes them to significant risks, including legal action and the potential loss of income they cannot afford.

- Rules to avoid: Some traders want to sell the bottle in order to avoid strict government exchange regulations. However, these rules exist to ensure fairness, transparency and investor protection. Leaving traders behind not only exposes them to legal risk but also undermines the integrity of financial markets.

Benefits of Legal Trading with Demat Account

While the sale of the bottle may offer some perceived benefits, these are expensive. The risks of illegal trading far outweigh the benefits. On the other hand, legal and regulatory trading through demat accounts offers several advantages that make it a preferred option for responsible investors.

- Rules of Compliance: Trading through a Demat account ensures compliance with the rules and regulations laid down by the Securities and Exchange Board of India (Sebi). This compliance assures that all transactions will be conducted in a transparent and fair manner and protects the interests of investors.

- Bank security: Legal trading systems come with built-in protections for investors, including dispute resolution mechanisms and compensation funds. These security measures help minimize the risks of fraud and misconduct, creating a safe trading environment.

- Process Logic and Statistics: Every transaction in a Demat account is recorded and traceable, providing a clear view of trading activities. This transparency builds confidence and ensures that investors can accurately manage their investments.

- Efficiency and Simplicity: Demat accounts simplify the trading process, enabling faster, safer and more efficient transactions. Eliminating physical share certificates reduces the risk of loss or theft and simplifies portfolio management.

- Tax Compliance: Legitimacy ensures that all businesses are reported and taxed appropriately, contributing to national revenue and supporting economic growth. This compliance not only contributes to sound financial management but is also consistent with responsible financial practices.

Encouraging Responsible Investment

Educating retailers about the risks of bottle marketing and the benefits of legally regulated marketing programs is important. By opting for a demat account, traders can enjoy a safe, transparent and regulated trading environment that protects their investment interests and contributes to the stability and growth of the financial market.

Opening a demat account is a good step towards financial responsibility. It provides the peace of mind that comes from knowing that your investment is safe and compliant. It is also aligned with macroeconomic objectives, supporting robust and transparent financial markets for the benefit of all stakeholders.

By choosing legal trading options, investors not only protect their financial interests but also participate in safeguarding the integrity of the financial system. This responsible approach to investing is key to long-term financial success and stability.