Can trading is the process where the broker provides the client with the option to trade from the stock exchange. The employee, acting as an intermediary, removes these trades from the regulated market. In traditional transactions, cashiers send goods to a broker and the transaction takes place in a Demat account. In the canning business, however, the investor delivers goods directly to the processor, who records these transactions in a personal ledger or record. The entrepreneur also handles the exchange of the trade, does so outside of government channels, and acts as a counterparty.

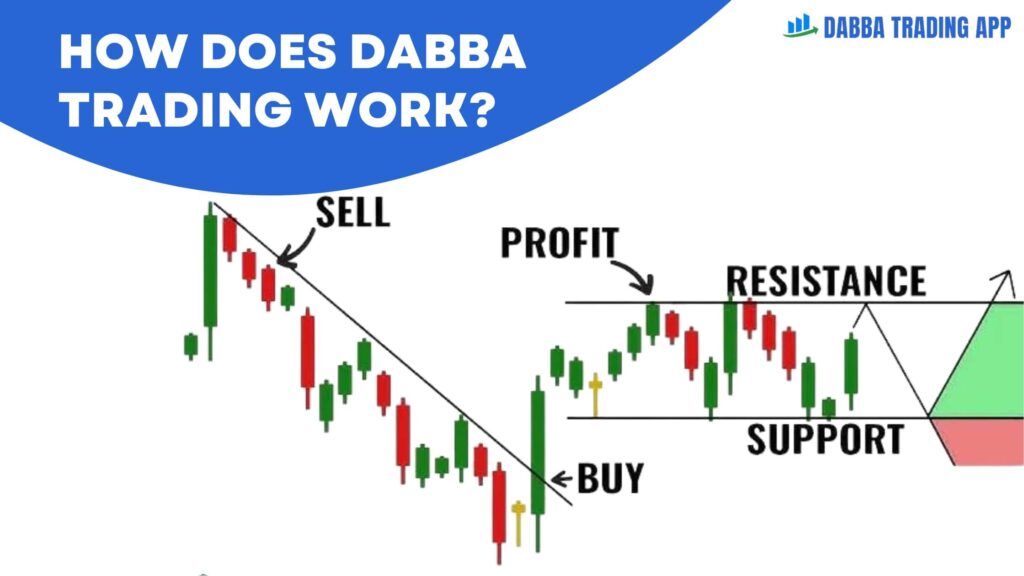

The Mechanism of Dabba Trading

Suppose an investor buys a multi-share Nifty call option of 50 units at ₹80 per unit, which is ₹4000 paid to the employees. If the Nifty index declines and the investor sells the call option at ₹50 per unit, the investor gets ₹2500, resulting in a loss. In this case, the benefit for the employees will be the difference, ₹1500. This example highlights the operator’s profit-making mechanism and the associated risks for the investor. If the operators continue to lose, they may shut down operations and abscond with the surplus, causing significant losses to investors.

Dabba Trading in Stocks and Commodities

Can handlers trade in stock and commodities. Generally, stock market trading involves Indian stock exchanges, while commodity trading is based on Multiple Commodity Exchange (MCX) prices, which facilitate the trading of various commodities Businesses charge minimum fees to investors and consume inventories on the MCX trade handling.

The Role of Dabba Trading Software

The rise of technology has had a significant impact on the bottle market. Operators now use automated software systems to efficiently handle many customer tasks. The software was designed to reduce human costs and accommodate the growing population. It interacts with stock and commodity markets to regulate prevailing prices, allowing operators to trade quickly and accurately.

Legal and Regulatory Challenges

Dabba trading operates in a legal gray area, which is widely considered illegal due to the evasion of regulatory oversight. Authorities continue to try to curb these activities, but enforcement remains difficult due to their clandestine nature. This regulatory ambiguity poses significant risks to investors, underscoring the importance of adhering to regulated trading systems.

summary

Can trading is an off-exchange trading method where brokers have private writing services. While it offers less cost through advanced software for better communication, it comes with greater risks, including potential fraud and lack of legal protection Investors are advised to hire government roads do not trade to protect their investments.

Conclusion

While can trading offers the lure of low margins and potential quick profits, it poses significant risks due to its unregulated nature and can result in significant financial losses and legal implications for investors on the snow. As regulatory frameworks are strengthened and financial literacy improves, the prevalence of bottle sales may decrease. But for now, this is a high-risk business that requires careful consideration and potential pitfalls.

How to Start Dabba Trading ?

Starting a stock market transaction can be profitable if you do it legally and ethically. Here is a simple guide to get you started on the right track.

- Main stairs

- Choose a reputable broker

- Open Trading Account

- Complete legal requirements

- Make a business plan

- Start working

- Learn and make changes

- Ethics and compliance

FAQs

-

- What is Dabba trading?

Dabba trading is an informal trading practice where transactions occur outside official stock exchanges, recorded privately by operators rather than in Demat accounts.

-

- How is Dabba trading different from regular trading?

Unlike regular trading on recognized exchanges, Dabba trading involves placing orders with an operator who records transactions off-the-books, bypassing regulatory oversight.

-

- Is Dabba trading legal?

No, Dabba trading is illegal as it evades the regulatory framework designed to protect investors and ensure market integrity.

-

- What are the risks of Dabba trading?

The primary risks include financial losses, potential fraud, lack of investor protection, and legal consequences due to its unregulated nature.

-

- How can investors protect themselves?

Investors should stick to regulated trading platforms, ensure thorough due diligence, and seek financial advice to avoid the pitfalls of Dabba trading.