Commodity Trading in Dabba Trading

In India's rapidly growing trading ecosystem, a term is often heard in back channels and local broker network is a dabba trading-a shadow market that has increased with formal exchange. When it comes to commodity trading, Dabba Trading plays a surprisingly large underground role. Let us see what it is, why traders are prepared for it, and include advantages and risks.

What Is Dabba Trading?

Dabba trading is an informal, off-market trading system where trades are held outside official stock or commodity exchanges such as NSE, BSE or MCX. Instead of rooting trades through regulated exchanges, a Dabba operator (local broker) records trades in his private books (“Dabba” means the box in Hindi word, referring to the laser of the operator).

Being illegal under Indian law, low cost, due to high demand for flexible trading solutions, continues to trading, especially in objects, especially in objects.

Commodity Trading: The Basics

Commodity trading involves the purchase and sale of physical goods or raw materials such as:-

Precious metals: Gold, silver

Energy: Crude oil, natural gas

Base metals: Copper, zinc, lead

Agricultural goods: Wheat, cotton, spices, soybeans.

Strict regulatory inspections include formal commodity trading on exchanges such as MCX (Multi Commodity Exchange) or NCDEX (National Commodity and Derivative Exchange).

But when traders visit Dabba channels, they trade these similar objects outside the official platforms, demanding speed, flexibility, and low cost.

Why Do Traders Use Dabba for Commodities?

The main reasons here are why commodity Dabba trading is popular:

✅ 1. Less cost:-

No exchange fees, SEBI fees, or GST. It reduces the costs per trade significantly.

✅ 2. High leverage:-

DABBA operators often offer more margins than formal brokers, allowing small traders to control large positions.

✅ 3. Rapid execution:-

No exchange delay; Trades are immediately executed on the operator’s books.

✅ 4. Local support:-

Dabba brokers usually have strong local networks and often provide services in regional languages, creating a trust.

✅ 5. 24/7 access (for some assets):-

While formal exchanges contain trading hours, some DABBA networks allow round-the-clock trading, especially for foreign currency or international commodities.

✅ 6. Privacy:-

Because trade is far from books, many traders feel that their activities are more private (although it is legally risky).

Benefits of a Dabba Trading App for Commodities:-

With the rise of mobile technology, many DABBA operators now provide dabba trading apps for commodity traders. Here are some benefits:-

- Simple user Interface: Easy-use dashboard to keep an eye on commodity prices and positions.

- Live Rates: Real-Time Commodity Price Feed.

- Quick Order: Buy/Sell items with a tap.

- Rapid extraction: Some apps offer payments for the same day’s benefits.

- Local language Support: Regional users were completed.

- High leverage Access: Margin trading features directly in-app.

These apps are designed to give small or local traders a sense of professional, fast transactions trading without the formalities of large brokerage.

Risks of Commodity Dabba Trading

Despite the alleged benefits, serious risks are attached:-

⚠ Validity: Dabba trading is illegal in India, which means that there is no legal support when dispute arises.

⚠ No regulation: Without SEBI oversight, traders have no protection against fraud, manipulation or broker lapse.

⚠ Opposition Risk: If the operator fails or disappears, traders may lose their entire capital.

⚠ No formal records: Trade is only present in the books of the DABBA operator, which makes profit verification or legal claims difficult.

⚠ Tax theft Risk: Earning from DABBA trading is unpublished, which can lead to serious legal issues on investigation.

Why It Still Thrives

Despite the risks, commodity dabba trading flourishes as it meets some market demands:

- Small traders seeking high leverage.

- Cost-sensitive traders avoiding formal fees.

- The bookies were designed for the fast growing local markets.

- Traders are disappointed with formal regulatory restrictions.

It also has deep historical roots, especially in areas such as Mumbai, Gujarat and Rajasthan, where local business networks are culturally entangled.

Final Thoughts

Commodity Dabba Trading is an attractive, although risky, part of India’s financial landscape. Although it gives traders a high profit, rapid execution and luring low cost, it comes with a high price of illegality and risk.

If you are interested in commodity trading, it is firmly recommended to detect legal, regulated routes through MCX or authorized brokers. These platforms provide the same market opportunities but with safety measures, legal support and appropriate records.

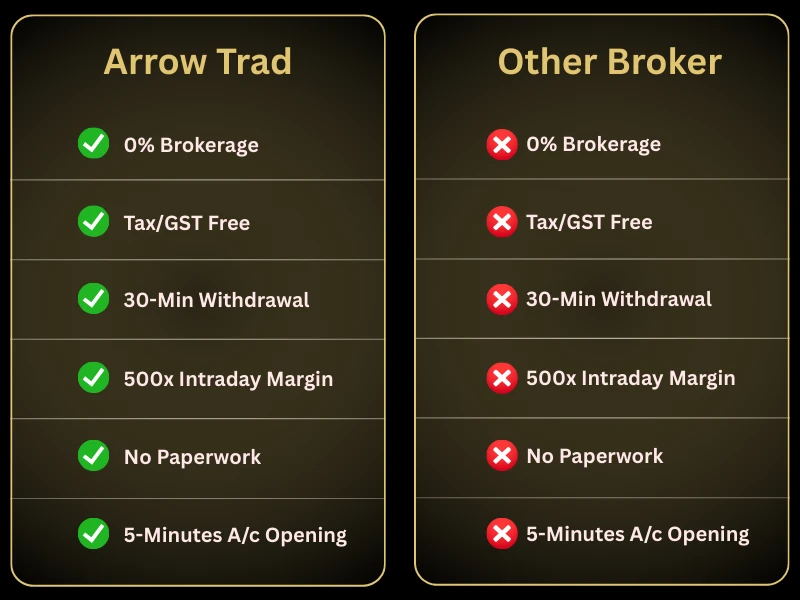

Why Choose Us

The challenges faced by the global market are our innovative solutions.

24*7 Support of Dabba Trading Brokers

At Dabba Trading, we prioritize your trading journey with around-the-clock support. Whether you’re making deposits, withdrawals, or need guidance, our dedicated team is always ready to provide seamless, efficient assistance.

Thank you for joining us on the path to financial empowerment and embracing the transformative power of blockchain technology!